- LGES marks KRW 25.6 trillion in consolidated revenue and KRW 1.2 trillion in operating profit in 2022

- 2023 goal set at 25-30 percent increase in annual revenue, with over 50 percent increase in capital expenditure

- The company to concentrate on four key initiatives to respond to the rising battery demands and effectively target the North American market

LG Energy Solution (LGES; KRX: 373220) today announced its 2022 whole-year and fourth quarter earnings, posting record-high annual consolidated revenue and operating profit.

At the conference call, the company also revealed its 2023 revenue target to increase the annual revenue by 25 to 30 percent from the previous year, through the expansion and stable operation of global manufacturing facilities, as well as increasing sales in the North American region.

For the full year, LGES reported KRW 25.6 trillion in consolidated revenue and KRW 1.2 trillion in operating profit, marking an on-year increase of 43.4 percent and 57.9 percent respectively.

“A record-high annual revenue was made possible, as battery shipment has increased across all product line-ups in our proactive response to the increased demands for EVs and power grid energy storage systems (ESS),” explained Chang Sil Lee, CFO of LG Energy Solution at the conference call. “We have also expanded the reflection of major cost increase into the average selling price (ASP), which also played a role in achieving a notable performance last year.” Lee added, “Thanks to economies of scale led by sales growth, cost saving achieved through improving productivity, and expanding price-competitive metal sourcing, annual operating profit has also shown a significant growth compared to the previous year.”

LGES also reported its fourth quarter financial results of KRW 8.54 trillion in consolidated revenue and KRW 237.4 billion in operating profit. The fourth quarter revenue of 2022, marking a record-high, increased by 12 percent from the previous quarter (KRW 7.65 trillion) and by 92 percent year-on-year (KRW 4.44 trillion), driven by increased EV battery sales for major customers, production ramp-up at the GM JV (Ultium Cells) plant in Ohio, and volume growth in ESS for power grids.

“Despite positive effects of economies of scale led by shipment growth and continuous improvement in productivity, the fourth quarter operating profit has seen a temporary drop on quarter due to one-off factors such as the recognition of employees’ incentives in line with the sound annual financial results and incremental expenses for ESS battery replacement,” explained LGES. “Excluding the one-off impacts, the operating profit remained similar to the previous quarter.”

■ Aiming for 25 to 30 percent revenue growth in 2023

LGES also announced it will pursue 25 to 30 percent increase in the annual consolidated revenue in 2023. The company also plans to increase its capex by more than 50 percent from the previous year’s KRW 6.3 trillion.

“We aim to meet our annual target revenue mainly through the expansion and stable operation of global manufacturing facilities, as well as sales expansion in the North American region,” explained LGES. “We will also continue to enhance the operating profit by improving the cost curve and advancing differentiations in product competitiveness.”

LGES has continued to strengthen its strategic partnerships with global automakers throughout the year by starting the ramp-up at the GM JV (Ultium Cells) plant in Ohio, as well as announcing new joint ventures with Stellantis and Honda. Now, the company plans to further expand its global production capacity to 300GWh by the end of this year.

With this goal in mind, LGES will proactively increase the production capacities of its manufacturing facilities in North America, Europe, and Asia. In North America, where the fastest growth in EV market is expected, the company’s production capacity is expected to reach 55GWh, thanks to the operation of two Ultium Cells plants in Ohio and Tennessee. In Poland and Asia (including South Korea and China), the production capacities are also expected to expand to 90GWh and 155GWh, respectively.

The company’s order backlog has recorded KRW 385 trillion at the end of last year.

■ Four Key Initiatives to Respond to the Rising Global Battery Demand

LGES forecasted this year’s global battery market demand will reach 890 GWh, a 33 percent increase from the previous year (670GWh).

By region, North American battery market is expecting the fastest growth of mid-to-high 60 percent range, thereby leading the expansion of the whole global battery market. European and Chinese markets are also expected to expand by mid-40 percent and mid-20 percent, respectively.

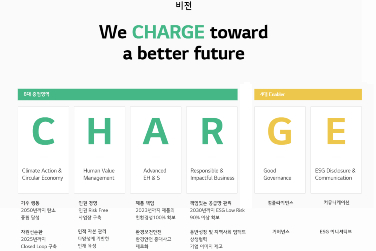

To proactively respond to the increase in the global battery demand, LGES will concentrate on four major initiatives: 1) promoting product competitiveness, 2) materializing smart factories, 3) establishing supply chain management system, and 4) securing future readiness through developing next-generation battery technologies and new business areas.

“Based on our strong execution we will continue to further reinforce our products’ competitive advantage and global operation expertise, thereby providing the world-best customer value,” said Youngsoo Kwon, CEO of LG Energy Solution.