The market for energy storage system (ESS) is expanding as the world advances its carbon-neutral policy and the demand for renewable energy develops. The announcement of green energy initiatives by countries like the United States, Japan, and Germany is driving up demand for ESS. With the advent of an environmentally friendly era, the amount of power provided by renewable energy is increasing. As a result, constructing a new generation of electric grid capable of regulating loads and stabilizing renewable energy output has become an urgent aim, with ESS at the forefront of the endeavor.

Why should we care about ESS?

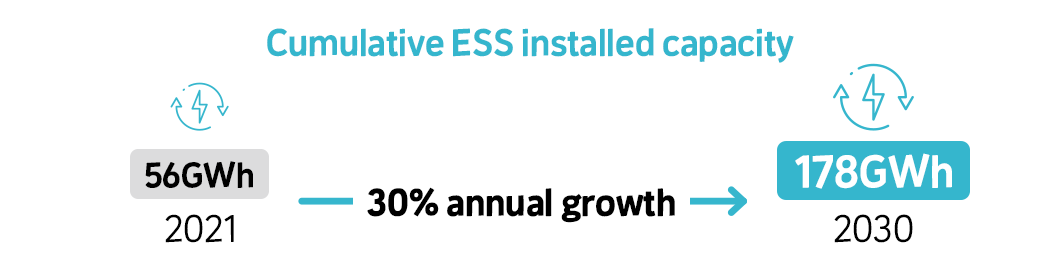

According to a report released in March 2022 by energy research firm Bloomberg NEF, the global cumulative installed capacity was 56 GWh in 2021, with the global ESS market predicted to reach 178 GWh annually by 2030 and the ESS industry expected to increase at an annual average of 30%.

As the energy system is exposed to various environmental changes, such as rapid climate change-induced summer and winter power peaks, large-scale power outages, and the spread of renewable energy, the need to develop high-capacity, low-cost ESS systems to prepare for power uncertainties is growing.

ESS is a system that enhances energy efficiency by distributing stored power when it is needed the most. ESS can overcome the limitations of traditional power grid systems and address the issues associated with intermittent renewable energy sources such as solar and wind power. A huge amount of electricity may be stored and used as needed, making it beneficial for a wide range of applications such as big power installations like electrical, commercial, residential, UPS (uninterruptible power supply), and communications. Households can save money by storing electricity when it is inexpensive and using it when it is expensive. Furthermore, in the event of a sudden natural disaster, such as a hurricane, it can provide power to help prevent a massive power outage.

In the long run, the ESS industry will expand as the renewable energy market expands. This is because, as wind and solar power acquire a larger share of the overall power generation, the necessity for an ESS installation to maintain power stability and efficiency grows. The governments of each country are expected to provide policy support as the demand for ESS increases to ensure the efficiency of renewable energy generation.

<What makes up ESS?>

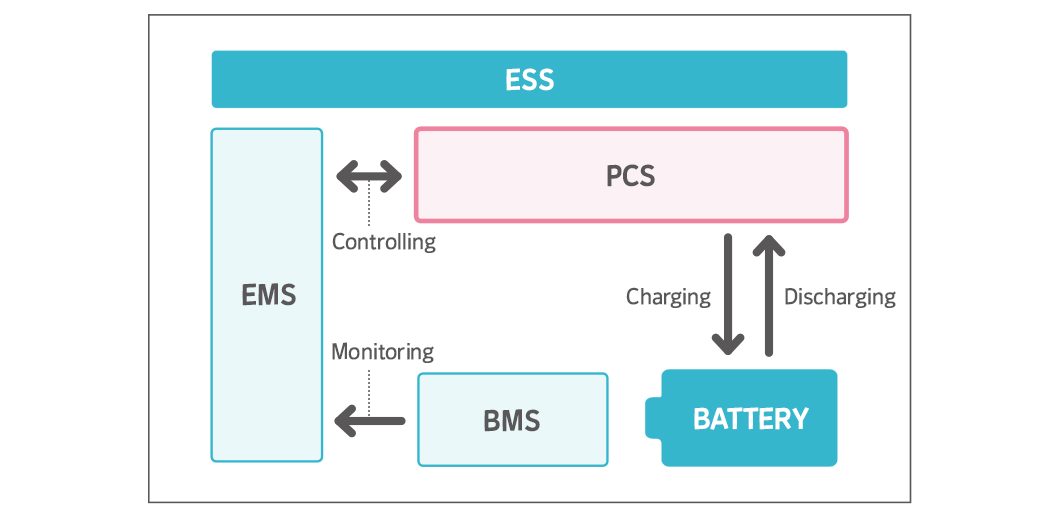

The ESS is made up of four major parts: the battery, the PCS, the BMS, and the EMS. The Power Conversion System (PCS) converts alternating current to direct current and vice versa. The Battery Management System (BMS) allows the ESS’s dozens or thousands of battery cells to operate as one and protects the ESS by preventing charging and discharging when it detects voltage, current, or temperature anomalies. The Energy Management System (EMS) monitors the electricity levels stored in the ESS and serves as the ESS’s general operating software.

What is the global market trend for ESS?

According to SNE Research, a global market research agency, the global ESS market was 11 GWh in 2019, and 20 GWh in 2020. It is expected to reach 302 GWh by 2030, with a 35% annual growth rate. The company anticipates significant growth over the next ten years as the global energy trend shifts and countries deepen their carbon-neutral alliances. Wood Mackenzie, a research organization, has named energy storage as one of the most promising technologies that will help Europe meet its 2030 objective of decreasing emissions by 55% compared to 1990.

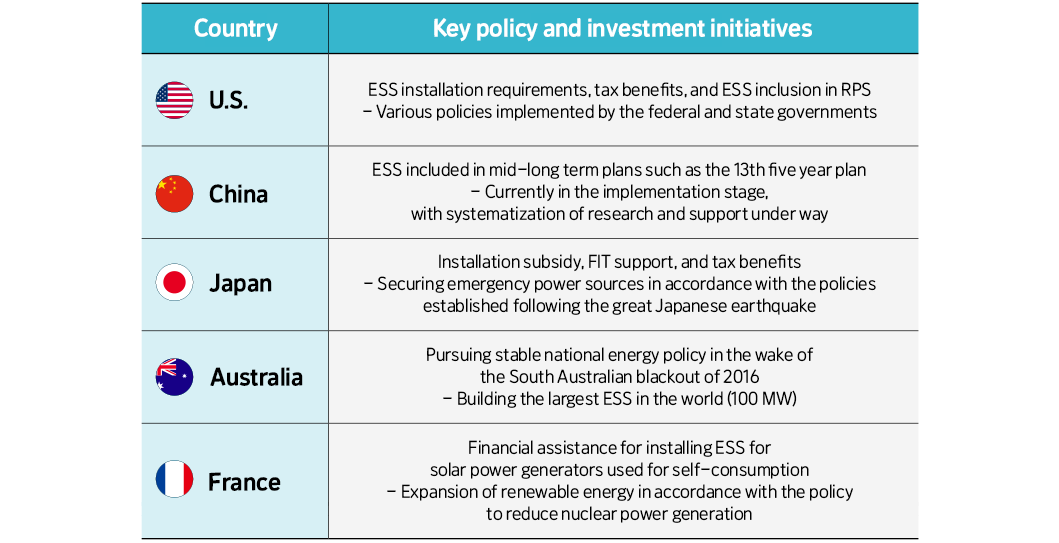

The United States is predicted to be the world’s largest ESS market, followed by China, Australia, and India. Key nations with a fast-growing ESS market are driving the industry by revitalizing the free private market through the implementation of an energy market platform and reinforcing strong power regulatory obligations.

The Biden administration is shifting away from a focus on fossil fuels and toward clean energy policies such as developing renewable energy technology, increasing investment in renewable energy sources and power grids, transforming the energy that powers public transportation networks, and improving energy efficiency in buildings. As a result, the government is working on legislation that will provide tax breaks for anyone who establishes an ESS. California, Oregon, and Massachusetts have all passed legislation mandating the establishment of ESS.

The United States is pursuing the ESS market by commercializing residential ESS. Residential ESS stores power for emergency use in houses. It is a valuable source of energy in the event of a natural disaster, such as an earthquake or a tsunami. The Texas outage demonstrated the usefulness of residential ESS.

The Chinese government has set a target of establishing the world’s leading “new energy storage” technology industry, with ESS at its core, by the year 2030. The ESS, which is a mass collection of lithium-ion batteries, is a novel technology that stores power and makes it available when needed, similar to how water is kept in a reservoir for reliable water supply. The Inner Mongolia Autonomous Region, Xinjiang Autonomous Region, Xizang (Tibet) Autonomous Region, Yunnan Province, and Sichuan Province, which have mega-scale clean energy clusters with solar, wind, and hydro-power facilities, will benefit from “reservoir energy storage” technology, which will ensure reliable power supply.

China has announced that it will develop and commercialize “reservoir energy storage” technology by 2025. By 2030, it intends to apply reservoir energy storage technology to all Chinese sectors. As for ESS, the Chinese government has stated unequivocally that the nation must “achieve the independence of key technologies and equipment.” It has given Chinese battery manufacturers CATL and BYD a competitive advantage in the market.

In the UK, the capacity of non-hydroelectric renewable energy sources has grown by almost 35 GW during the last ten years, with an annual growth rate of 6.3%. The government operates a Feed-in-Tariff (FiT) system, which ensures an adequate level of profit for ESS connected to renewable energy. Australia is also supporting the growth of ESS paired with residential solar to reduce electricity bills, and Germany and Japan are exempting taxes on renewable energy and grid access fees.

What is required for ESS to be competitive?

To create a safe and long-lasting ESS, we must upgrade batteries and provide sophisticated system monitoring capability. Technical research is being conducted to overcome the limits of lithium-ion batteries, which are currently used in ESS, as well as to develop alternative types of batteries to replace them.

Along with the development of hardware technologies, such as batteries and materials, components, and equipment for ESS, the development of software across operating systems for efficiency and reliability is essential. Furthermore, developing services such as energy monitoring can aid in the development of a more sustainable energy storage industry.

In keeping with the global ESG trend, Korea unveiled the Renewable Energy 3020 Plan in 2017, which will raise the amount of eco-friendly electricity generation from solar and wind to 20% by 2030. It was specified at the time that a particular percentage of ESS be installed in large-scale public buildings that consume more than one megawatt of electricity.

As a result, domestic battery businesses are expanding their ESS operations in order to prepare for the renewable energy age and to recycle waste batteries. Korean companies are aggressively pursuing the ESS upstream sector, not only by producing and delivering ESS batteries but also by pushing after-sales service and forming new businesses. As the ESS market grows, they are also extending and internalizing the value chain.

In the face of strong competition, LG Energy Solutions’ acquisition of NEC Energy Solution, an ESS system integration (SI) company, is significant. Beyond supplying ESS batteries, this move strengthens all ESS-related industries, such as business strategy, design, installation, and maintenance. With this move, the company will be able to provide complete ESS services, including large-scale ESS and after-sales support, giving it a competitive advantage.

< What kind of company is NEC Energy Solution?>

NEC Energy Solution, which has its headquarter and R&D facilities in the United States, has executed more than 140 ESS integrated services projects in countries such as Australia, London, and Brazil. In 2020, its revenue was estimated to be 240 billion dollars (roughly 287.3 trillion won), representing a 60% increase over the previous three years.

The company has been highly rated for its exceptional IT capabilities, such as its proprietary energy management system (EMS) software, AEROS®, which is a critical component of the ESS SI project, and for its maintenance capabilities based on more than ten years of global operational data.

Following the acquisition, LG Energy Solution Vertech Corporation, which will be in charge of the ESS SI business, will be established to secure its ESS business capacity, allowing it to respond to customers without having to deal with battery-related supply and demand issues, which account for more than half of the ESS project’s cost. Furthermore, by combining key materials and equipment, such as batteries and PCS, the company will be able to offer an optimized ESS service.

The ESS market can be won by offering a comprehensive solution that goes beyond battery supply. This is due to the fact that delivering tailored service and quality to clients can provide a competitive advantage. Additionally, the government’s active support for the local ESS industry is crucial. Technical competitiveness will be increased by accurately identifying safety hazards and providing support for the development of next-generation batteries.