The hot topic of the battery industry currently is “end-of-life batteries.” The growth of the global EV market is followed by the increase in batteries that have reached the end of their lives in EVs. Accordingly, governments across the world are setting policies for reusing or recycling those batteries. Today, we will delve into the trend of the global end-of-life battery industry.

Q. What is the forecast for the end-of-life battery industry?

As the EV market expands, the number of EVs that reach the end of life is expected to grow. If they could be either recycled or reused, that will not only be good for environmental protection but also offer many opportunities for harnessing them for various purposes. Indeed, this is a high value-added market.

SNE Research, the market research firm specialized in energy, predicted that the number of transportation vehicles such as battery electric vehicles and plug-in hybrid electric vehicles that reach the end of life will rise 33% a year on average until 2040, starting from 170,000 in 2023 and marking 4.11 million in 2030 and 42.27 million in 2040. The amount of end-of-life batteries is expected to follow the trajectory, growing from 18GWh in 2023 to 338GWh in 2030 and 3,339GWh in 2040, showing a significant hike during the decade.

Hence the attention on the end-of-life battery recycling market. The value of the global battery recycling market is forecast to jump 17% a year on average from USD 10.8 billion in 2023 to USD 42.4 billion in 2030 and USD 208.9 billion in 2040.

Q. What are end-of-life battery policies of governments across the world?

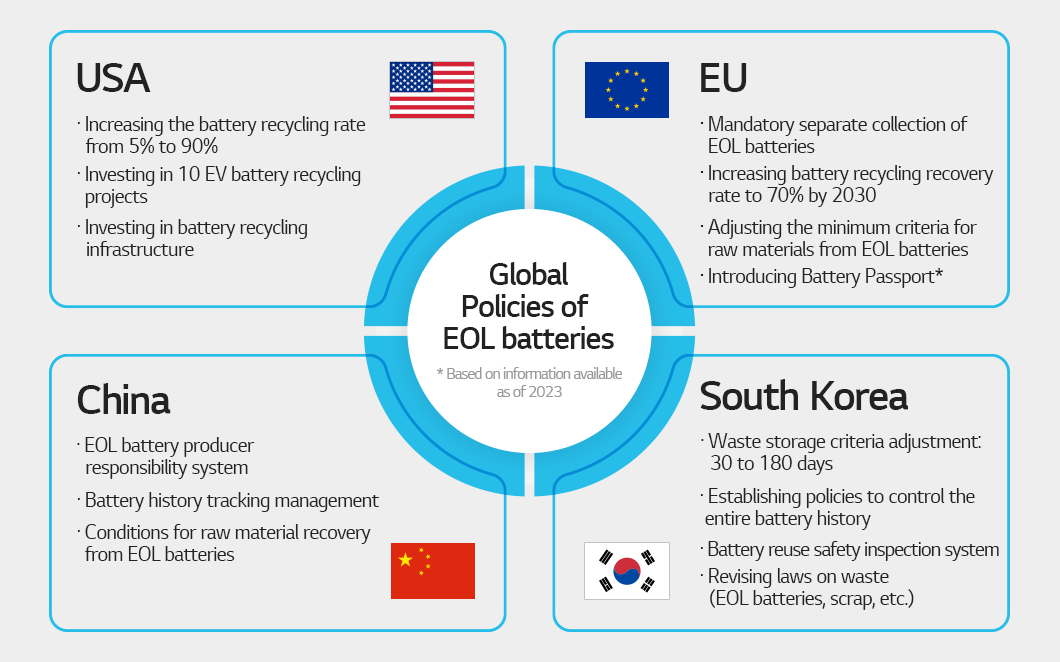

Countries across the world have different policies to respond to the growing end-of-life battery market.

The U.S. is introducing battery recycling policies continuously. The Inflation Reduction Act plans to raise the amount of battery recycling significantly from 5% to 90%. The country will invest USD 74 million in 10 EV battery recycling projects and expects it will be able to secure the techniques needed for recycling end-of-life batteries through the projects. Also, it decided to invest USD 20.5 million in the battery recycling infrastructure and USD 3.1 billion in EV and battery companies.

The EU passed the Battery Regulation to promote a circular economy and reduce environmental impact in June 2023. It also has policies for recycling end-of-life batteries.

According to the policies, separate collection of end-of-life batteries is mandatory for each producer or producer responsibility organization, and collected batteries have to be processed at authorized facilities. The EU has a goal to achieve an overall recycling recovery rate of 65% by 2025 raise it to 70% by 2030, and adjust the minimum criteria for the raw materials recovered from end-of-life batteries. And introduction of the “Battery Passport*” will be mandatory for the users or sellers of reused or recycled batteries. The information on the passport of the original battery and that of the reprocessed battery has to be in sync.

*Battery Passport: An open digital platform that offers all information about the battery’s life cycle including from raw material collection to production, consumption, disposal, reuse, and recycle via a QR code on the battery

China is also serious about battery recycling. The country has a producer responsibility system for end-of-life batteries that demands battery producers to release the battery’s history and mandates recycling them. To collect key raw materials from end-of-life batteries, China set recovery targets, which are 98% for nickel, cobalt, and manganese, 85% for lithium, and 97% for other rare metals. Besides, the value of its battery recycling projects amounted to above CNY 100 billion in the first half of 2023. The more than 100 projects include recovery of EVs, storage, and separation of end-of-life batteries, and recovery of raw materials, a testament to how China is harnessing end-of-life batteries in various ways.

South Korea is establishing new policies as well, making a lot of effort to support end-of-life battery business. The government established the Safety Inspection System for reusing batteries as it amended the Electrical Appliances And Consumer Products Safety Control Act in October 2022. The law went into effect in October 2023. It also plans to introduce policies to control the entire history of batteries, encompassing the supply of raw materials, production, consumption, and reuse.

The government also revised some systems to offer the foundation for battery reusing and recycling. Before, a recycling company could store only 30 times of the scraps it could process a day among those gained from end-of-life batteries or the battery manufacturing process. Now, the criteria is changed from the amount of 30 days to 180, which would contribute to more effective recycling.

Q. What is the LG Energy Solution’s recent end-of-life battery project?

LG Energy Solution also rolled up its sleeves and began its end-of-life battery project in earnest. The battery maker established a battery recycling joint venture with Huayou Cobalt in August 2023. This partnership offers the first battery recycling joint venture plant between South Korean and Chinese companies to be built in China.

The joint venture with the Chinese cobalt supplier will deal with battery scraps and extract key materials for manufacturing batteries such as nickel, cobalt, and lithium from end-of-life batteries. Construction of the plants began in Nanjing city in Jiangsu province and Quzhou City in Zhejiang province in 2023. Each plant will take different roles, with the Nanjing plant managing pre-treatment of dealing with scraps, and processing end-of-life batteries while the Quzhou plant manages post-treatment, processing recycled metals. The plants are expected to start operation in late 2024.

Also, the metals that will be produced at the joint venture will be used for manufacturing batteries. They will be processed into cathodes and delivered to the Nanjing production plant of LG Energy Solution.

We have learned the trend of the end-of-life battery industry and how LG Energy Solution is striving to create a closed loop of resource circulation. LG Energy Solution will continue to stay committed to environmentally friendly management!