- LG Energy Solution posts KRW 6.8778 trillion in consolidated revenue and KRW 448.3 billion in operating profit

- The company secures large-scale supply agreements leveraging new form factors and chemistries

- The company to effectively address EV/ESS market needs, with the long-term focus on operational efficiency, R&D, and business portfolio expansion

SEOUL, October 28, 2024 – LG Energy Solution (KRX: 373220) today announced its third quarter earnings, along with its quarterly progress reports and action plans for EV and energy storage system (ESS) battery businesses.

The company posted consolidated revenue of KRW 6.8778 trillion, a 11.6 percent increase quarter-on-quarter and 16.4 percent decrease year-on-year. The operating profit was KRW 448.3 billion, a 129.5 percent increase quarter-on-quarter and 38.7 percent decrease year-on-year. The operating profit includes the estimated IRA tax credit amount of KRW 466 billion. Excluding the IRA tax credit, the company would have recorded quarterly operating loss of KRW 17.7 billion.

“Expanded sales to major European automakers and increased production at our joint venture facilities in North America and Indonesia, as well as substantial ESS revenue growth from grid-scale projects, improved the overall revenue compared to the previous quarter,” said Chang Sil Lee, CFO of LG Energy Solution.

“We also saw quarter-on-quarter improvements in the operating profit excluding IRA tax credit effect on the back of improved utilization rate led by shipment increase in both EV and ESS batteries, as well as reduced unit cost burden in line with metal price stabilization,” Lee said.

■ Recent Progress: Large-Scale Supply Agreements for New Form Factors and Chemistries

LG Energy Solution successfully secured large-scale orders from top global automakers for its new form factors and chemistries totaling 160GWh, further advancing its goal of leading global innovation in EV batteries.

The major supply agreements include a contract for 50GWh of cylindrical batteries with a major automaker to power EVs sold in North America. With the deal, the company has expanded its customer portfolio for cylindrical EV batteries from primarily EV start-ups to established automakers, and secured stronger market presence in North America through local production capability.

For pouch-type NCM[1] EV batteries, LG Energy Solution secured supply agreements totaling 109GWh for commercial vehicles sold in Europe, leveraging the chemistry’s technological competitiveness characterized by high-power and long-life cycle. These agreements are also expected to contribute to improving the Poland facility’s production efficiency once the production starts after the second-half of 2026.

■ Action Plans for EV and ESS Battery Businesses

For EV battery business, as customers are increasingly interested in applying more diversified battery chemistries and form factors tailored to different EV segment, LG Energy Solution will offer various chemistry choices to customers, such as LFP and High Voltage Mid-Ni to support all EV segments. On the same note, the company will further diversify its product form factors by starting mass production of its 46-Series cylindrical batteries.

To address increasing needs of cost innovation for core EV components, the company will continue to advance its materials and process technologies. For battery materials, it will apply industry-leading material technologies such as single crystal cathode and silicon contents in anode. Also, it will focus on developing dry electrode technology to achieve higher energy density and cost innovation, with the goal of applying it to mass production in 2028.

In addition, responding to rising importance of EV safety, LG Energy Solution is developing multiple solutions to reinforce its product safety, including advanced thermal propagation (TP) prevention technology for pouch-type batteries. The company also completed the development of optimized cooling module structure for cylindrical batteries.

For ESS battery business where strong demand momentum is expected, especially in power grid, LG Energy Solution will actively respond to long-term, large-volume projects in North America, leveraging its stable production know-how and local supply capability, creating opportunities to generate stable revenue. To enhance competitiveness, the company also plans to launch high capacity LFP ESS batteries, along with advanced energy management and system integration (SI) software. To maximize the benefits from policies supporting local manufacturing, the company will start ESS battery production in the U.S. next year and also consider converting EV production lines to ESS in response to the European market demand.

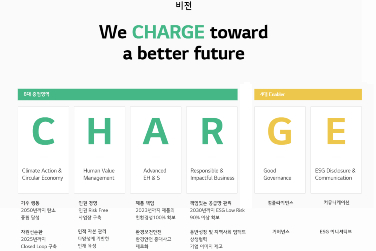

In the mid to long term, LG Energy Solution’s key strategic initiatives will be: proactively adjusting operation, reinforcing R&D investment, and expanding business portfolio.

1) Proactively adjusting operation: Scale down capacity expansion and adjust ramp-up speed to maximize utilization rates of existing lines

2) Reinforcing R&D investment: Secure differentiated material and process technologies, accelerate R&D for optimized chemistry and form factor solutions, develop next-generation batteries such as bipolar semi-solid batteries and sulfide-based solid-state batteries

3) Expanding business portfolio: Establish a closed-loop recycling system on a regional basis, expand BaaS[2] /EaaS[3] businesses, explore new market opportunities for other applications beyond EVs

“While we expect unprecedented shifts in external environments, we will be nimble in responding to these changes through our comprehensive business strategy,” said David Kim, CEO of LG Energy Solution. “Capitalizing on our unmatched product portfolio, we will enhance the values we’re providing to our customers, thereby securing solid leadership in the global battery market.”

[1] NCM: nickel, cobalt, manganese

[2] BaaS: battery-as-a-service

[3] EaaS: energy-as-a-service