The elements that make up the cathode materials in lithium-ion batteries vary depending on the required performance, which has been continuously evolving through improvements in energy density, for example. However, even if the cathode material generates a large amount of energy, the energy would not be efficiently used when the anode material, which is responsible for storing the energy, cannot handle it. Also, the better the anode material receives lithium ions, the shorter the charging time will become. This achievement would be felt more by users than they would with any advancement involving cathode materials. Anode materials have such an important role to play. Let’s look at the current development landscape of the anode materials.

The anode generates electricity by inserting and releasing lithium ions from the cathode (+). In long-lasting batteries, the anode material can repeatedly accommodate the insertion and release of lithium ions. Graphite, both natural and artificial, has long been the primary anode material. This is because its well-ordered layered structure allows lithium ions to be inserted between its layers. However, when lithium ions are inserted, the internal structure of graphite particles expands, and their surface becomes unstable. As a result, the ability to insert and release lithium ions decreases, ultimately shortening battery lifespan. As battery performance and capacity improve, the need for next-generation anode materials that enable faster charging is growing.

![]()

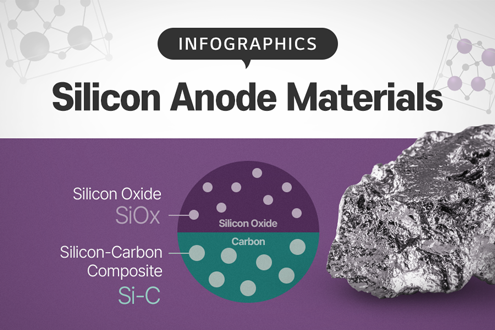

Silicon is emerging as the next-generation anode material to succeed graphite. While graphite can store one lithium ion per six carbon atoms, silicon can store 4.4 lithium ions per silicon atom. This gives silicon anodes a capacity of more than ten times higher per gram than graphite anodes. By dramatically increasing energy density, silicon anodes not only extend the driving range of EVs but also improve the feasibility of fast-charging battery designs. Moreover, silicon is an economical and environmentally friendly material, further solidifying its status as a promising next-generation anode material.

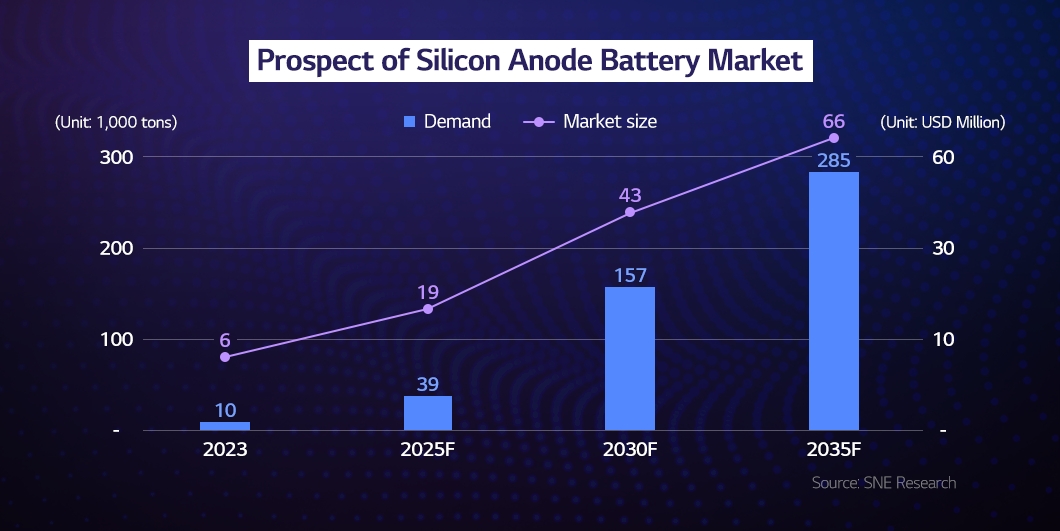

Experts project that the anode material market for rechargeable batteries would grow as the electric vehicle market expands. The silicon anode market, in particular, is expected to grow significantly. The silicon anode material market, valued at approximately $600 million in 2023, is projected to reach $6.6 billion by 2035.

However, there are still looming problems involving silicon anode materials, particularly the volume expansion that takes place during lithiation and the tendency to break. These are major hurdles to overcome. Nevertheless, in 2019, LG Energy Solution applied a 5% silicon anode to a pure electric vehicle for the first time in the world. It is currently pushing to apply a 7% silicon anode for the first time globally. As LG Energy Solution continues to innovate its technologies, look out for more of the company’s successful advancements.